March 13th, 2024

Many sectors in India are still grappling with the multi-dimensional impact of COVID-19 pandemic.

Continue Reading

September 6th, 2023

Until now, the tax justice and climate justice movements have mostly tended to operate in isolation from each other, despite having many common goals and objectives.

Continue Reading

January 13th, 2023

The year 2023 is going to be crucial for financial transparency and tax justice, as countries around the world desperately seek funds amid multiple crises, whist grappling with the impact of the COVID-19 pandemic.

Continue Reading

October 26th, 2022

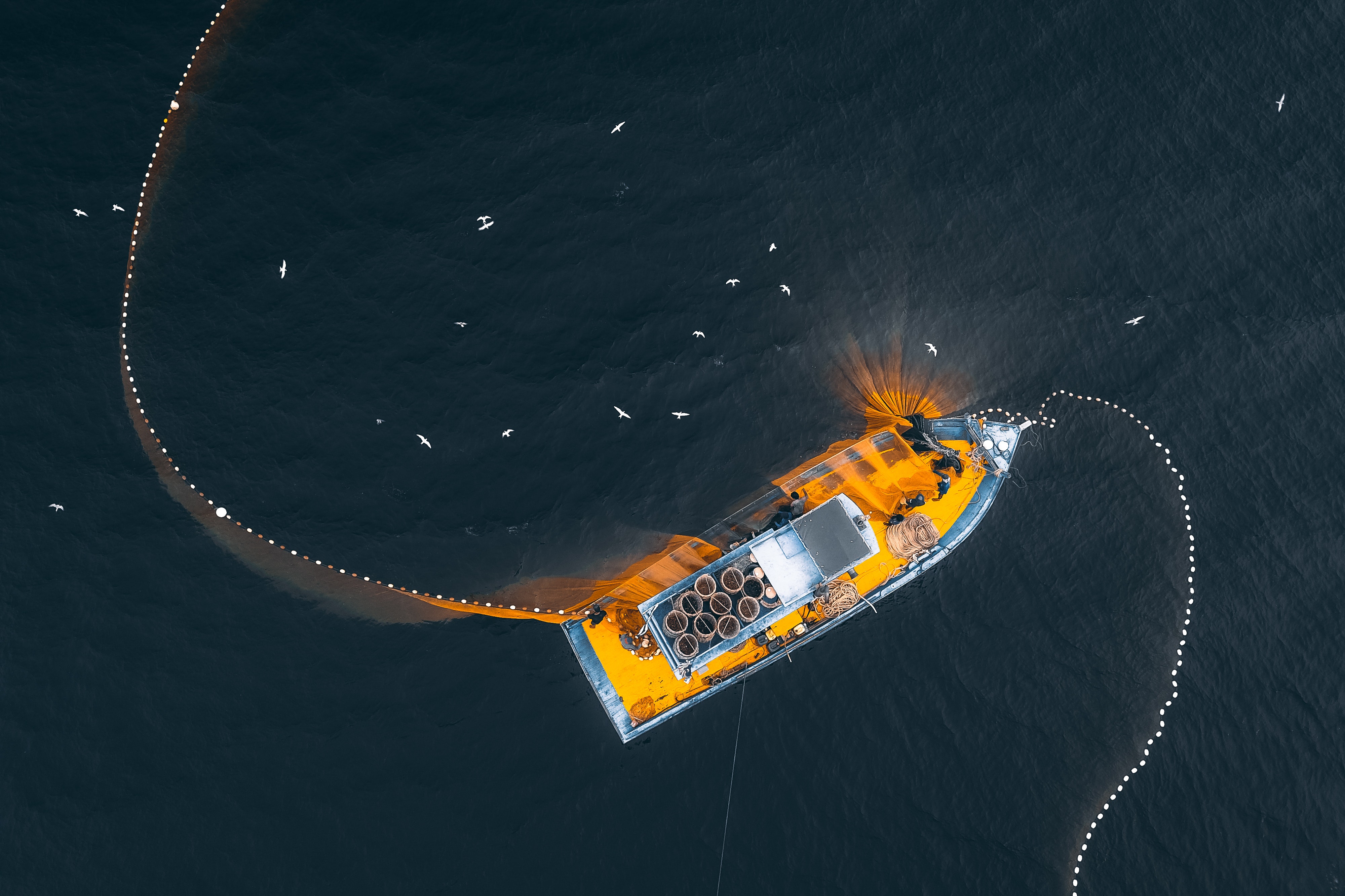

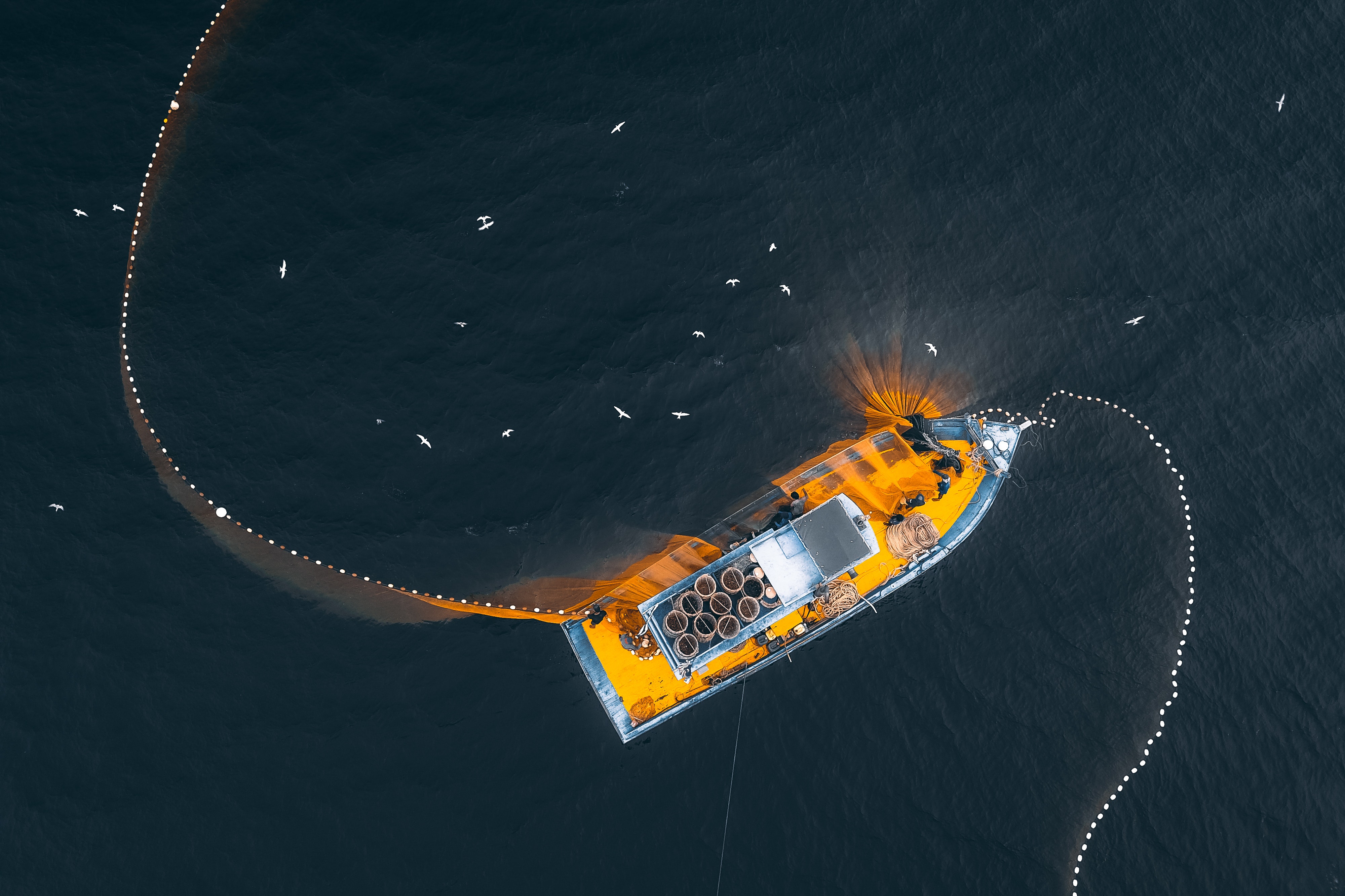

WASHINGTON, D.C. – Africa concentrates 48.9% of identified industrial and semi-industrial vessels involved in illegal, unreported, and unregulated (IUU) fishing,

Continue Reading